Blog > Housing Report > Featured Stories > Michigan Property Taxes in a Nutshell

Michigan Property Taxes in a Nutshell

Topics

- Housing Reports

Subscribe

Get the latest Michigan Housing Reports delivered straight to your inbox!

Topics

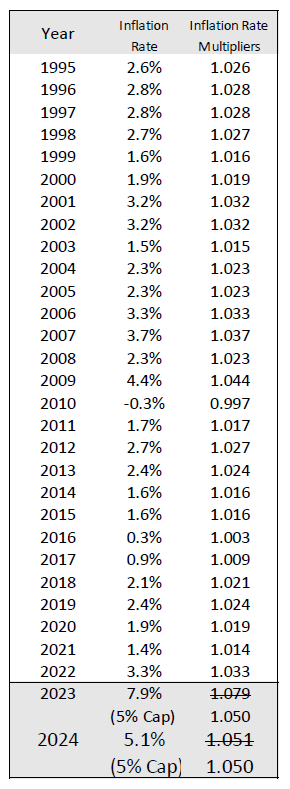

After several years of rapidly rising prices and mild inflation (until the past two years) homebuyers and sellers need to be aware of the potential for a significant jump between existing taxes and future taxes after the sale. Michigan’s Headlee Amendment was passed in 1994. Its goal was to limit tax increases during periods of rapid rising prices so that people with fixed incomes wouldn’t be taxed out of their homes. Headlee limits/caps how much a homeowner’s taxable assessment can be raised—the lesser of the prior year’s rate of inflation or 5%.

State Equalized Values are based on property value. Between 2012 and 2023 property values in Southeast Michigan rose 145%, but capped values (base on inflation) for property owners that remained in their homes during that period rose just 19%.

A seller’s current taxes are usually irrelevant as a predictor of future taxes. Since Headlee, Michigan property tax assessments contain three values:

• State Equalized Value (SEV): 50% of the assessor’s estimate of the true cash value of the home as of December 31st of the prior year.

• Capped Value: Last year’s Taxable Value multiplied by the lesser of the inflation rate or 5%.

• Taxable Value: The lesser of the SEV or Capped Value.

At some point in the past, an assessor estimated the value of each property. Since then, assessors have mathematically adjusted the value based on their sales statistics for that neighborhood. This may go on for years or decades without an assessor revisiting the property.

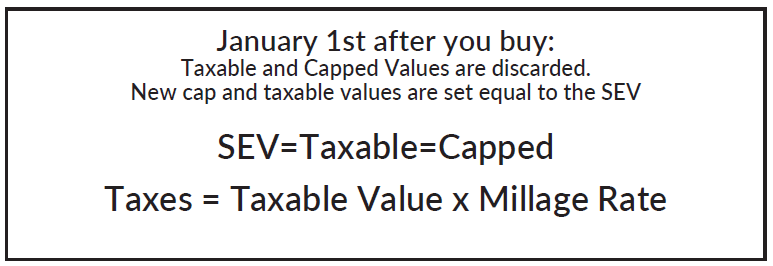

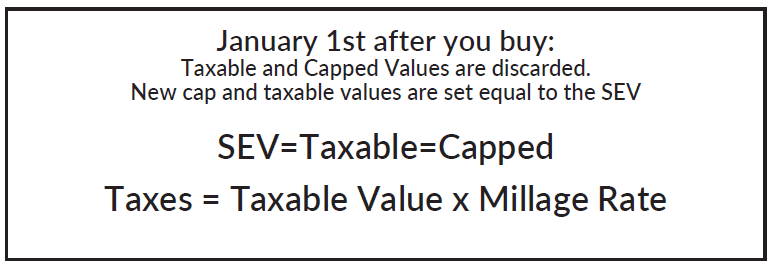

When a Home Sells: In Michigan, on January first, after a home sells, the previous owner’s Capped Value and Taxable Value are discarded and the SEV (adjusted for last year’s statistical gains or losses for that neighborhood) becomes the new starting point.

What a previous seller or their neighbors paid for taxes is irrelevant. What the buyer pays may also be irrelevant unless:

1.) the SEV is greater than 50% of the sale price; and

2.) the new owner can establish that what they paid is the market/true cash value of the property.

Michigan Property Taxes in a Nutshell

2 minutes

Deprecated: preg_split(): Passing null to parameter #2 ($subject) of type string is deprecated in /usr/share/wordpress/blog/reo_blog/wp-includes/formatting.php on line 3506

After several years of rapidly rising prices and mild inflation (until the past two years) homebuyers and sellers need to be aware of the potential for a significant jump between [...]

Southeast Michigan 2024 Housing: Trends and Predictions

2 minutes

Deprecated: preg_split(): Passing null to parameter #2 ($subject) of type string is deprecated in /usr/share/wordpress/blog/reo_blog/wp-includes/formatting.php on line 3506

Through the first half of 2024, expect demand to continue to outweigh supply. However, as the year progresses, expect to see inventory gradually rise into a more balanced position as [...]

’23 Market Summary and ’24 Predictions

< 1 minute

Deprecated: preg_split(): Passing null to parameter #2 ($subject) of type string is deprecated in /usr/share/wordpress/blog/reo_blog/wp-includes/formatting.php on line 3506

After a few years of supply shortages, inventory began to return to more normal levels in the second half of 2023. Demand remains strong and buyers continue to wait for [...]